Why Are Car Insurance Rates Getting More Expensive in Kenya?

Posted on 2018-09-11 in: Motor Insurance in Kenya Car Insurance in Kenya

The cost of living in Kenya has steadily risen affecting most households across the country. With the increasing costs, most car owners are also starting to feel the pinch from the higher comprehensive car insurance rates on the market. While rates had climbed sharply at the start of the decade mandated by the Insurance Regulatory Authority (IRA), competition and price undercutting has forced the rates to come lower over the last few years. Car insurance companies in Kenya after suffering heavy losses have steadily started raising the insurance rates for cars across the board. While the rates for comprehensive car insurance have been on a steady increase, we see third party motor insurance costs remaining fairly unchanged. Using the insurance industry report for 2017 to understand gives a clear background as to why this is becoming the trend.

Private Motor Insurance Rates

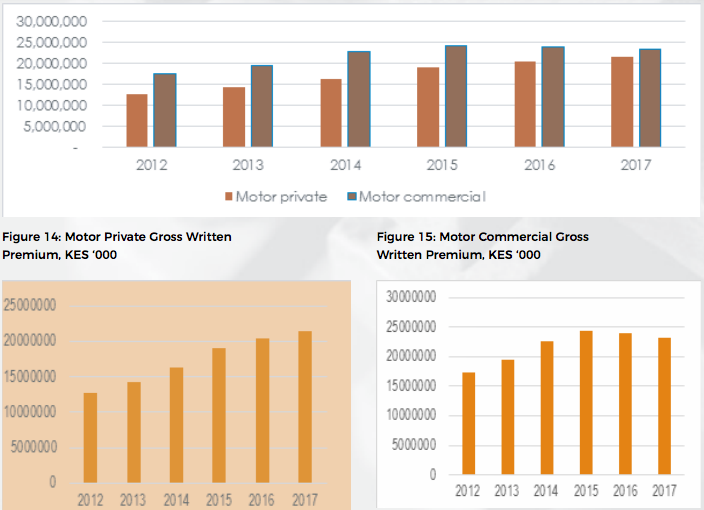

Total gross premiums underwritten for motor private insurance were just over KSh 21.5 Billion for the year 2017 recording a 5% increase from the year before. This accounted for 17% of the total insurance market. Of the insurance premiums collected, just over KSh 14.3 was the total claims incurred by the insurance companies. Add to that another KSh 8.4 Billions and the industry fell into a loss of KSh 2.75 Billion for the motor private insurance business class. The hardest hit car insurance companies were UAP General and CIC General insurance, BRITAM Insurance, suffering losses of KSh 400 million, KSh 540 million and KSh 495 million respectively. The only profitable providers among the top car insurance companies in Kenya were APA insurance and AIG at KSh 85 million and KSh 25 million respectively. Only 11 motor insurance companies reported a profit in this class of business.

Multiple reasons can be used to account for these prevalent losses including the ever-increasing level of fraud in the industry. Many consumers have gotten involved in rackets of criminals who are notorious for defrauding companies. There are many rings who engage in stealing and reselling spare parts, intentionally writing off motor vehicles for claims pay-outs.

In addition there are also fraudulent service providers like garages, assessors who have profited from car insurance claims.

The lack of an insurance data sharing system has also cost the insurance companies heavily. Many fraudulent claimants have taken advantage of this loophole to drive these insurance companies into underwriting losses by launching several claims during the insurance period and benefiting from multiple insurance companies.

The car insurance rates for private motorcars stands at roughly 3.5 – 4.5 % of the value of the car from most car insurance companies in Kenya. Jubilee insurance and APA insurance offer different insurance rates depending on the age and value of the vehicle but the majority of the industry still offers flat rates for all vehicles.

While the IRA in Kenya had earlier mandated insurance companies to offer motor insurance covers in the range of 7% of the value of the vehicle, stiff competition and under cutting has led to the price decline to present levels.

PSV Motor Insurance rates

The commercial motor insurance segment fares much better in terms of profitability of the underwriters in Kenya.

From the table presented below, the segment made an underwriting profit of KSh 450 millions. Cushioned by the motor commercial insurance business (own goods carriage, general cartage, special vehicle types like graders, diggers, excavators, etc.), this has performed much better compared to the motor private insurance segment.

This segment has also greatly benefited from the professionalization of the PSV motor insurance segment. With the advent of UBER, TAXIFY and LITTLE cabs in the Kenyan app hailing market, this has driven the uptake of PSV motor insurance for chauffeur driven cars.

However, this has also come with the heavy losses from partial and total theft and the high accident rates on this car usage. For that reason this has seen the rates for PSV motor insurance companies go up to a basic of 6% of the value of the car. In addition, most PSV insurance companies in Kenya have shied away from covering these vehicles on the market due to the heavy losses incurred. The cost of insurance add-ons has also risen sharply and some providers have gone away from offering the popular add-on of excess protector.

Third Party Car Insurance Rates

While motor insurance rates are generally going up, this type of cover has remained fairly constant premiums. The going rate for most private motor vehicles starts at KSh 5063 per annum all the way to KSh 10,000.

For PSV motor insurance for vehicles used on the UBER, TAXIFY and LITTLE platforms, the insurance rates are charged at a flat rate of KSh 9,580 per annum. Quite similarly, the insurance rates for motorcycle cover have not changed much over the last year despite the growing number of motorcycles on the roads. What has changed however is most insurance companies in Kenya don’t offer PSV motorcycle insurances, the so-called Boda-Bodas. This is because of the high-risk profile of this business class especially with the passenger legal liability. This is yet another growing business line with the advent of app hailing companies that have formalised the once informal sector. Previously, the main contribution was from the private motorcycles and commercial or corporate motorcycle fleets. Insurance companies have been bitten by court cases that take years and mandate huge pay-outs for loss of life, disabilities etc. well after the insurance period has lapsed.

Comparison of Car Insurance rates in Kenya vs. USA & UK

While most motorists in Kenya will complain of the ever-increasing car insurances rates in Kenya, car owners abroad have it a lot worse! In Europe and America the rates for owning a car can be even higher than 100% of the cost of the car. This is because the ratings are based on the insured and not the vehicle itself.

For the USA, the average car insurance annual premiums were USD 1,308 (equalling KSh 131,000) with the highest state clocking in at USD 2,060 (nearly KSh 200,000) per annum. In the USA, car insurance rates vary very drastically state by state and also depending on the age of the insured, the young drivers are charged very high rates because they are notoriously more dangerous behind the wheel. It is not uncommon for young adults to pay as high as USD 5,000 per annum for their car insurance premiums. The rates are also split by gender where ladies typically pay slightly lower rates for their premiums.

The type of car insured also affects the rates significantly, for shiny sports cars like Ferraris, one can expect to pay very high insurance premiums compared to ordinary family sedans and vans. This is one similarity with Kenya where some insurance companies charge high car insurance rates for specific types of cars like BMWs, Subarus and the likes. Vehicles that have been traditionally associated with young carefree drivers with high insurance claims ratios. More common is the comprehensive insurance in the West as compared to the third part motor insurance in Kenya which is the minimum requirement as per the CAP 405 road traffic rules. Because of the different factors that go into pricing for the product, customers have to shop around online comparison platforms in order to get the best car insurance rates on the market.

Table showing a summary of the car insurance market in Kenya 2017.

| Motor class | Car Insurance rate (basic) | 2017 insurance Premiums | 2017 insurance Claims | Profit/Loss |

|---|---|---|---|---|

| Motor Commercial | 6% for PSV chauffeur | 23.2 billions | 12.9 billions | 451 millions profit |

| Motor private | 4% | 21.5 billions | 14.2 billions | 2.75 billions loss |