Claims is the most important part of any insurance and yet often it is a disappointing experience for the consumer.

Client satisfaction is paramount in what we do, our professional staff will assist our clients and ensure that they are handled in a correct, transparent and timely manner on claims service and processing.

Our claims personnel will provide assistance on claims handling, administration and management by making sure we continue to provide a trusted and quality claims service and equitable settlement to our clients who rely on us.

We use a new 3 STEP approach to dealing with claims right from process of clients purchasing the insurance cover to the events after the claim is reported.

BEFORE YOU BUY

We want our customers to understand the insurance cover provided better. We believe in educating our customers and empowering them to buy the right cover for the unfortunate risks they face. We allow our clients to compare insurance policies and choose the best cover at their convenience. We highlight the benefits of each policy and also emphasise the key sections like Excesses, Exclusions, Caveats, Pre-requisites and Terms and Conditions. Our industry leading platform PESABAZAAR.com really makes the complex things easier, all at the consumers' convenience. Should you have any query about any insurance policy, our professional and reliable staff will be able to advise you in person, on the phone or electronically to make sure you get the right cover for you.

AFTER YOU BUY

We continue to provide tips, updates, answer any queries and provide assistance to our customers on how to reduce and mitigate any risks to your self, family, investments and assets. We also continue to advise to our clients in respect to changes in the laws of the Republic of Kenya, the Insurance Act of Kenya and any relevant Insurance Industry policy changes.

WHEN THE CLAIM IS REPORTED

We provide our clients with a range of services including full hands-on management of a claim, advice and assistance on claims requirements to our clients, negotiation, coordinating with insurance providers, assessors, loss adjustors and other other service providers to make the claims process faster and more efficient.

On reporting a claim, we will advise you if the the loss is covered, if a claim on the policy is admissable to the insurer, work with the client to file a claim with the insurer and document the claim from the point of admission to when a final decision is made on the claim.

We will continuously follow up with the insurance provider and other insurance intermediary service providers to ensure that the claim in settled correctly and timely to the client's best possible interest.

We make every effort to make sure that the claims process is quick and efficient and that the outcome is to the client's possible interest, however we can not influence/coerce the settlement decision by the Insurance providers. We are also not able to make final decisions on claims, any decisions are solely made by the Insurance provider.

OUR CLIENTS

To help us correctly and quickly achieve correct settlement of your claim, we ask our clients to follow the below simple guidelines:

- Notify us as soon as you possible of any potential claim on your insurance policy

- Take all necessary steps to reduce any further risk and damage to yourself, property and the public

- Notify the Police or any other relevant authority of any loss suffered, where applicable

- If another party is involved get full contact details, vehicle details and photographic evidence where applicable

- Where necessary, present witnesess/testimonies to cooperate with appointed representatives

- Promptly report the claim to us and or Insurance Company

Motor Insurance

In the unfortunate event that you are involved in a motor accident, here are the important steps you need to take to make the insurance claims process as smooth as possible get you back on the road faster.

- Try to remain calm and help others if any involved to also remain calm. Accidents can be a distressing experience.

- Make sure all those involved are physically alright and in case of bodily injury please seek medical attention immediately by calling for an ambulance.

- Do not admit fault to anyone as this may be used against you in the claims process or Courts of Law.

- Ensure to involve the police. Allow them to control the accident scene and help determine who is at fault.

- You may take photos of the scene of the accident and damaged motor vehicle(s), road marks and any other features of the accident scene that may be useful during the investigation of the accident.

- Ensure to obtain any relevant information from everyone involved in the accident. Information such as names, addresses, phone numbers, and motor insurance details are important as they may be using during the insurance and any criminal investigations.

- Report the claim as soon as possible to your insurance provider and or PESABAZAAR.com

- Maintain strict confidentiality of the case, do not discuss any matters pertaining to the case with anyone except the police and your insurance provider.

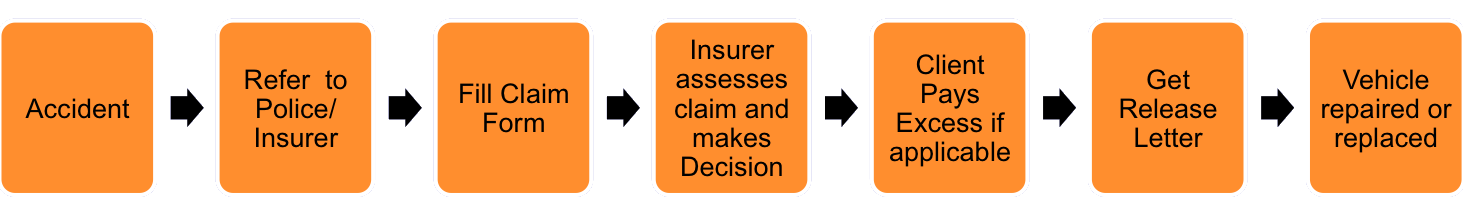

After a claim has been submitted, it will follow many stages before it is finalised and closed. Here are the main steps that most of the motor accident claims follow.

Medical Claim Procedure

Submit duly executed claim form which can be obtained from the insurer or downloaded in the website within 30 days from date of service.

- Ensure you attach the following documents.

- The membership number of client and facility visited.

- A detailed medical report if it was an inpatient case.

- An original invoice and receipts of payment done and keep copies for your own records.

- If it’s an inpatient claim an itemized hospital bill will be required.

- For overseas claim, letter of approval is normally issued prior to the services and hence a copy of that letter should be attached.

- For a last expense/funeral claim, a copy of burial permit/death notification form will be required.

- Give reason for seeking reimbursement (since services can be authorized directly with provider without having to pay).

- Provide Bank details.

Prescriptions

- Prescriptions are fully covered under outpatient.

- If you have an inpatient cover only they are covered to a specific number of days e.g AAR does for the first 14 days after discharge and UAP does it for the first 21 days after discharge.

Emergency Cases

- Call the emergency numbers provided on the membership card or sticker for rescue and evacuation.

- If you were taken to the hospital by a good Samaritan ensure you inform your insurer within 24 hours from the time the emergency occurred.

Getting a Pre-authorisation

- After a physician orders for a medical service for a patient, they contact the insurer to determine if they recquire a prior authorization check to be run.

- If so a process is initiated to obtain prior authorization.

- The authorization varies from one insurance provider to another.

- This will include completion of an authorization form.

- If a service is rejected the physician can appeal based on the provider’s medical review process.

Guide to make when getting treatment.

- Walk to a provider with your medical cover card.

- Produce it to the reception/front office staff of the facility.

- They will check whether it is up to date and if not you will be advised accordingly.

- They will key you in the system and request for visit fee which varies from insurer to insurer and if again it’s applicable.

- You will be requested to wait for your turn.

- Once you are called you will go and see the specialist.

- If there is lab tests to be done you will proceed to the laboratory.

- After the results are out you will go for a review and prescriptions will be given.

- Collect your prescription and proceed to the reception where you will be provided with a bill of all the stages you went through and the cost will be deducted from your card.

- You are advised to always request for a copy of the invoice at each given visit.

- Collect your card and leave the premise.

Travel Insurance

The majority of the international travel insurance policies available in Kenya will be re-insured or underwritten by internationally reputed insurance providers like AXA, Allianz, TravelSafe, MAPFRE and others.

This means that if you are travelling overseas, you will be covered by international insurance experts who have a global network and reach.

For medical emergencies and any other personal accident, please contact your insurance provider using the emergency telephone numbers provided on your insurance policy. You will receive assistance immediately 24hrs 7 days all year round.

To make a claim under your policy, you may be required to produce the following or more documents/evidence at YOUR own cost:

Medical Emergency claims

- Receipts or bills for all in-patient/ out-patient treatment or emergency dental treatment received.

- Receipts or bills or proof of purchase for any other transport, accommodation or other costs, charges or expenses claimed for, including calls to the Emergency Assistance Service.

Baggage Loss/Delay

- A police report from the local Police in the country where the incident occurred for all loss, theft or attempted theft.

- A Property Irregularity Report from the airline or a letter from the carrier where loss, theft or damage occurred in their custody.

- An original receipt, proof of ownership or valuations for items lost, stolen or damaged and for all items of clothing, medication and toiletries replaced if your baggage is temporarily lost in transit for more than 12 hours.

- All travel tickets and tags for submission

Travel Delay/Curtailement

- A medical certificate from the treating medical practitioner explaining why it was necessary for you to cancel or curtail the trip.

- Booking confirmation together with a cancellation invoice from your travel agent, tour operator or provider of transport/accommodation.

- In the case of curtailment claims, written details from your travel agent, tour operator or provider of transport/accommodation of the separate costs of transport, accommodation and other pre-paid costs or charges that made up the total cost of the trip.

- Your unused travel tickets.

Please read your policy document for more details on the claims procedure and supporting documentation required.

Golfers Insurance

To make a claim for golfers insurance, you may have to present the following to your insurance provider :

- National ID/Passport and Copy.

- Description of the event.

- Receipts for any golf equipment.

- Any letters of claim from members of the public or third parties.

- Where applicable, a letter from the police/authorities detailing the event.

Mobile Insurance

KENYA ORIENT Mobile Insurance

No one wants to believe that an accident could happen to their mobile phone / tablet; let alone it being stolen or lost.

For those who have experienced one of the above, you know the stress and hassle of getting your mobile phone / tablet replaced. It is a nightmare; especially the stress of getting a new phone! Yet there is an easy way to protect yourself from this hassle. ORIENT MOBILE; another first from Kenya Orient Insurance Limited.

Have complete peace of mind, knowing that your mobile phone / tablet is insured and you can reconnect with family, friends and work. With ORIENT MOBILE, we understand your love of staying connected.

Kenya Orient Mobile Insurance partners

- ✔ FoneXpress Kenya

- ✔ TUSCOM with Tusky's

- ✔ Naivakom at Naivas

- ✔ APhoneLink Kenya

For theft claims you need to visit any one of the dealers with:

- Claim form

- Police abstract

- Stamped blocked request form from network provider > Purchase receipt/warranty

- Original & copy of ID/passport

For damage and repair claims

- SMS the word ‘MOBILE’ to 70707

- Receive an SMS with a link to a website

-

Click on the link and be directed to the Orient Mobile Welcome Page

3 options are displayed

- Secure my phone / tablet

- Report a claim

- Check the status of my policy / claim

- Select Report a claim

- Enter your ID or passport number

- Select device from the list and enter contact mobile number and email address

-

Fill in the following details

- Type of claim

- Date of incident

- Nearest town

- Description of the incident in which the device was damaged or lost

- Type of liquid the device had contact with (if applicable) or where did the loss occur

- Description of any visible damage to the device for damage claim or where the loss occurred for theft claim

- Screen displays device make & model, device’s year of manufacture, device’s value, confirms claim type - damage or theft, provides claim reference number and a request to check an email for claim registration form.

-

Visit OMB dealer for damage claim with:

- Claimform (which you received by email from STEP 8)

- Damaged device

- Purchase receipt/warranty

- Original copy of ID/passport for damage claim

What we require for Personal Accident (PA) / Group personal accident (GPA) Claims:

Notify us immediately, and provide the following documents

- Duly completed claim form;

- Medical certificate by the attending doctor;

- Claimant’s payslips for three months prior to the accident;

- Discharge summary (if admitted in hospital)

- Sick off sheets by the attending doctor(s);

- Original medical receipts;

- Original police abstract report, if any;(accident cases)

Incase of fatal accidents provide:

- Original death certificate

- Post mortem report

What we require to process Property Claims

From the insured:

- A duly filled Claim Form

- Original police Abstract Report

- Replacement Invoice/Purchase Receipt /Proforma Invoice

- Statement on the circumstances of the loss

- Adjusters Final Report

- Adjusters Fee Note

- Acceptance of Loss Form/Discharge Voucher

- Letter forwarding documents to reinsurers

- Other (specify) …………………………….

From the third party:

- Assessors report and invoice

- Repairers invoice

- Satisfaction note

- Police abstract

- Proof of special damages/payments

- T.P. driver’s statement/sketch plan

- Car hire arguments for loss of use